-

What changed on 1 July?

August 4, 2022A reminder of what changed on 1 July 2022 Business Superannuation guarantee increased to 10.5% $450 super guarantee threshold...

00 -

Tax & the family home

August 4, 2022Everyone knows you don’t pay tax on your family home when you sell it…right? We take a closer look...

-

Business Boost Grants

August 4, 2022Next round of Business Boost grants on the way Small businesses ready to take their business to the next...

-

Tax Time Tips

June 7, 2022Here are a few things to consider coming up to tax time for individuals: – Save on tax by...

-

Meet the team – Kim

June 7, 2022Kim joined McFillin in 2015, this was Kim’s second employment as a Client Service Officer (Admin) as she...

-

Changes to superannuation guarantee from 1 July 2022

June 7, 2022The statutory Superannuation Guarantee rate will increase from 10% to 10.5% of ordinary time earnings from 1 July 2022....

-

ATO continues to target Cryptocurrency disposals

June 7, 2022The ATO is increasing its collection of information from Cryptocurrency Exchanges to ensure Australian taxpayers are declaring their earnings...

-

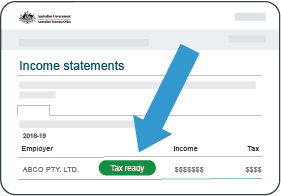

Lodge your Single Touch Payroll Finalisation Declaration

June 7, 2022At the end of each financial year, you are required to finalise your Single Touch Payroll (STP) data by...

-

Changes to Single Touch Payroll with Phase 2

June 7, 2022Single Touch Payroll (STP) Phase 2 is an expansion of the ATO’s payroll reporting system, and it started on...

-

Director Penalty Notices

May 6, 2022ATO warns of impending action Recently the Accountants Daily published an article warning of impending action by the ATO...